The Story Behind Rewirement

Click edit button to change this text. Lorem ipsum dolor sit amet, adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

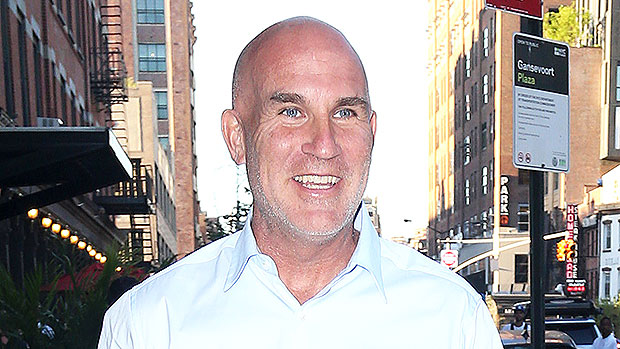

RON SUBER

Today on the Listen Up Show we discuss financial services and fintech lessons learned by Ron Suber. The San Francisco

Business Times calls Ron the godfather of FinTech. Some people in the industry refer to him as the Mayor of Fintech. Humble, generous to his friends, and working on his next act called rewirement.

When asked about all this praise Ron just said labels are for soup cans not for people.

Ron is the former prosper marketplace

president. Others see Ron as the go-to guy for FinTech innovation Ron left prosper not to retire but as he terms it rewire as he enters the next phase of his life called rewirement myth he’s a lending

01:31

industry-led want to learn more about

01:33

how to start up a business sign up for

01:36

our newsletter and get access to

01:38

exclusive content plus a free copy of

01:42

our ebook 30 tools to start up get my

01:46

free ebook now just head on over to

01:49

mitchell chadroy comm slash sign up

01:52

that’s right

Mitchell Chad wrote calm slash sign up

on the podcast show we speak with

successful entrepreneurs private equity

investors nonprofits student leaders

startups that have grown to accessible

businesses and those serial

entrepreneurs that have built iconic

brands and have sold instances for

millions fintech gurus have developers

and so much more now enjoy the show

what are we going to learn on today’s

show what does it take to make things

02:41

happen how do you overcome hurdles and

02:44

obstacles what are the new barriers to

02:47

entry how do you constantly reinvent

02:49

yourself stay current in this

02:51

ever-changing industry called thin tech

02:54

and the past present and future of Stata

02:58

tech I am so excited that Ron is joining

03:01

us on today’s show because Ron is the

03:03

go-to guy when it comes to fin tech

03:06

innovation as an entrepreneur and an

03:08

investor we can all learn a lot about

03:10

entrepreneurship how to start up an

03:13

online business in any industry from Ron

03:16

Ron welcome to the show my friend

03:18

Mitchell happy holidays great to be with

03:20

you today and your audience yes thank

03:22

you so very much for coming on we are so

03:25

excited so how is your requirement going

03:28

well I’m six months into this period of

03:30

my life called rewire meant it is an

03:33

exciting time it’s really a time where

03:36

you get to be unemployed and you get to

03:38

take everything you’ve done and practice

03:40

and learn takes all the mistakes the

03:42

observations and the lessons and turn

03:44

them into other things and for me it’s

03:47

more meeting with entrepreneurs and

03:50

helping them to the pivots and the good

03:52

times on the bad it’s investing in the

03:54

equity of companies and in the debt of

03:56

companies and really sharing my

03:58

observations from personal life

04:01

entrepreneurship and business around the

04:03

world that’s truly exciting like I said

04:06

when I when I saw that word I thought

04:08

wow that is an awesome word to call me

04:11

and I certainly wanted to ask you you

04:14

know how things were going as it relates

04:16

to that so you love to travel you’re

04:19

just actually coming back from the from

04:21

the FinTech lended conference in

04:23

Australia I know that you’ve done that

04:25

five years in a row can you can you

04:27

recap just a few financial lessons

04:29

learned that the trusted friends on the

04:32

listen up show can take away from from

04:34

your experience there at the conference

04:36

absolutely I think that people are as

04:39

excited as ever

04:41

or as scared as ever given what’s

04:44

happening with FinTech this collision of

04:47

finance and technology

04:50

and what you see around the world

04:51

whether you’re in Tel Aviv or London or

04:53

Sydney or Singapore that the incumbents

04:58

are feeling the pressure the incumbent

05:01

telecom companies the incumbent Bank and

05:03

candidly the incumbent technology

05:06

companies and the finance companies are

05:09

feeling it too because you now have

05:10

companies like ants Financial and

05:13

Alibaba and Amazon and PayPal and square

05:16

really connecting to this next

05:19

generation and changing the way payments

05:22

and money transfer money investment

05:24

borrowing lending and so much more is

05:27

happening and so all these companies are

05:30

needing to engage with us as

05:32

entrepreneurs with you and your audience

05:34

to learn how to pivot and really excel

05:38

in this golden era of FinTech that were

05:40

in today for the next 10 years you know

05:43

let’s dive a little bit deeper because

05:46

everybody in the audience has a

05:47

different level of experience in the

05:50

FinTech space and there are others who

05:53

are trying to obviously learn more about

05:56

it and get interested in it and that was

05:59

one of the other reasons why we

06:00

definitely wanted to have you on today

06:02

can you share with us the story of peer

06:06

to peer lending industry in the history

06:08

of online lending absolutely

06:10

I think people to think about the

06:12

FinTech revolution starting with trading

06:15

going online in the 80s and mortgage is

06:18

going online with alone and PayPal

06:21

changing payments and then to answer

06:23

your question in 2006 prosper and

06:27

Lending Club emerged as peer-to-peer

06:29

online lending companies or for the very

06:32

first time people could borrow and lend

06:35

to and with each other on the Internet

06:38

it was a small industry all the way

06:41

through 2013 candidly the companies were

06:44

doing just tens or 20s a million of

06:46

loans in a month it was quite immature

06:49

where people were still telling stories

06:52

and writing their life story and posting

06:54

pictures to try to get money from other

06:57

lenders and then in 2013 things changed

07:00

you’re the end

07:01

tree became institutionalized and we

07:04

brought in machine learning and big data

07:07

alternative data traditional data and

07:09

really innovated so that institutions in

07:13

2013 and 14 could now lend to other

07:17

people online in consumer loans and

07:20

student loans and business loans and

07:21

mortgages to ernow around the world it’s

07:26

ubiquitous in every country on every

07:28

continent people can’t access each other

07:31

to borrow and lend and so you’ve seen

07:33

now tens of billions of dollars a year

07:35

around the world where people can borrow

07:38

from other people and institution and

07:40

you see now ETF’s being created and

07:43

securitization and bonds being traded

07:46

it’s really just the beginning to early

07:48

days I think about this like the sharing

07:51

economy in the old days we used to share

07:53

things with each other pictures and

07:56

weather and emails and stories and now

07:58

we were in this access economy well we

08:01

can now access each other in different

08:03

ways like never before and this new

08:05

generation isn’t doing anything the way

08:07

the old generation did they want their

08:10

movies stream to them they want their

08:12

music stream to them and they want their

08:14

money stream to them as well so we’ve

08:17

we’ve talked to other FinTech kings in

08:20

this particular space who actually

08:21

futurists so we’ve actually spoke a

08:24

little bit about what’s happened in the

08:26

FinTech space peer-to-peer in the past

08:29

what’s actually going on here in the

08:31

present but can you take us a little

08:33

even deeper and let us know a little bit

08:35

about what your insights are in terms of

08:38

down the road what we have in store for

08:40

the future in FinTech that’s something I

08:43

think about a lot it’s such a great

08:44

topic to talk to other entrepreneurs

08:46

about it I think today it’s pretty

08:49

segmented by asset class and by

08:51

geography so here we can invest in

08:54

students in consumers in business and

08:56

franchises and mortgages in the US or

08:59

North America and in Asia they can do it

09:02

pretty much in Asia or Southeast Asia

09:04

and this thing for Europe or Latin

09:05

America my vision for the future is

09:08

there is a portal maybe a face book

09:10

right maybe it’s Amazon or Alibaba where

09:13

we can go and we can bar

09:15

ruin land around the world across all

09:18

asset classes

09:19

so think about Priceline and Expedia

09:21

they’re not worth a hundred billion

09:23

dollars in aggregate because they’re

09:25

connecting people around the world with

09:28

other people who want a hotel an

09:30

airplane ride or a car and uber is doing

09:34

the same and I think that’s what’s going

09:36

to happen with money you’ll be able to

09:38

sit in New York and I’ll be able to sit

09:40

in San Francisco and we’ll be able to

09:42

borrow from people in Asia or lend to

09:44

people in Mexico City it will truly be

09:47

global and it will be seamless like the

09:50

ubers and others that have shown us that

09:53

transportation or Airbnb and lodging

09:55

there is a better way and I think that’s

09:57

where we’re going with lending yeah no

10:00

it’s really fascinating so you know you

10:03

mentioned that you’ve you were president

10:06

of course at prosper marketplace for

10:09

four five years and you’ve now been in

10:11

your requirement now for about six

10:14

months so can you tell us a little bit

10:16

about your personal journey his leaving

10:18

prosper until my wife of 26 years and I

10:21

got rid of everything we accumulated

10:23

materially in our first 25 years of

10:26

marriage Hollywood a charity we bought a

10:28

new house and started over

10:29

and so we rewired personally so instead

10:32

of throwing each other out and starting

10:34

over we kept each other but through our

10:36

material things away and over my career

10:38

I have invested in 20 companies I’m

10:41

advising 10 of them formally and I’m the

10:45

chairman of the board of one of them

10:46

that we just took public in Australia

10:48

three weeks ago and I’ll be announcing

10:51

in January to other companies that I’ll

10:53

be advising and helping them with their

10:55

strategy with their pivot coaching those

10:58

entrepreneurs to try to achieve the

11:00

goals the mission vision and values that

11:02

those companies have in real estate and

11:05

other parts of the ecosystem we have

11:07

many different sponsors one of our

11:09

sponsors is hosting so when people go

11:11

over to Mitchell chadroy comm slash

11:13

hosting they can see all the different

11:17

hosting companies that our guests

11:18

actually utilized for their own

11:20

companies as well as the ones that they

11:23

invest in is there one or two that you

11:25

can sort of recommend and

11:27

be sure to link up to that as well so I

11:29

use a company to do all my hosting and

11:33

all my visual work if detron super calm

11:36

and it’s hosted by a company called

11:37

batteries included not only a great team

11:40

but a great name and they do all of my

11:43

Prezi presentations all of my hosting

11:45

all of my digital marketing and have

11:47

been a great partner for me in doing

11:50

what I do in rewire meant so as far as a

11:52

graphic designer today also like for

11:55

example canva for example would be a

11:57

competitor do they also do all your

11:59

graphic designer work as well they sure

12:02

do I actually published a piece that

12:05

they did called

12:07

Ron’s requirement lessons from the first

12:10

hundred 20 days and it went virtual and

12:12

viral it had 35 thousand shares around

12:15

LinkedIn and Twitter and if you look at

12:17

that piece posted at Ron’s oeuvre calm

12:19

you’ll see the quality and the style

12:21

that they’ve been able to do and all of

12:23

my presentations are very interactive

12:25

they’re in Prezi not PowerPoint and

12:28

that’s all produced manufactured and

12:30

edited creatively and technically by

12:32

batteries included are startup Brown

12:37

students business owners those

12:40

individuals out there who want to start

12:42

up something new they need a presence

12:44

online and they need a web hosting

12:46

company that they can trust and they can

12:49

count on and that’s reliable and helpful

12:51

so what did I do

12:53

I teamed up with the good folks at

12:55

hosting where they offer my podcast

12:58

audience 25% off their web hosting

13:02

package check them out at Mitchell

13:04

chadroy comm slash hosting that Mitchell

13:07

Chad rode calm so I should hosting start

13:09

your plan today you mentioned you are

13:11

acted in so many investments you’re on

13:14

the board you’re involved in so many

13:17

different management teams can you just

13:19

highlight a few and some key things you

13:22

have planned for them in the future so I

13:24

think that many of the management teams

13:26

are awesome

13:27

some of them are on the right ship but

13:30

in the wrong chair and other teams need

13:33

more people maybe more financial or more

13:36

marketing help or engineering help and

13:38

I’m really working with these

13:39

entrepreneurs to understand

13:41

the pain and to help them achieve what

13:43

they really think they can in 2000 18 19

13:46

and 20

13:46

I also think that some of these

13:48

companies are remanding globally some

13:50

need more equity so many more debt and

13:52

other challenges and pivots in the

13:54

business and I’m really helping those

13:55

young entrepreneurs move through their

13:57

good time and the not so good time with

13:59

all the regular challenges we know to

14:01

two companies in particular that I

14:03

wanted to get some of your insight on is

14:06

credible and DocuSign I think these

14:08

companies are just incredible and if you

14:13

could just give us a little bit more

14:14

insight into them that that would be

14:16

awesome for the audience absolutely

14:19

DocuSign is the leader in eliminating

14:22

paper and streamlining business and

14:25

saving time and in every country across

14:28

every continent there is a need or

14:31

smoother business process not just a

14:34

signature but in payment and this

14:36

company DocuSign is the leader around

14:38

the world and has so much opportunity

14:40

ahead of it across banking and

14:42

healthcare and real estate insurance and

14:44

so much more what a great team and a

14:47

great global presence and brand I think

14:50

that credible is like a Priceline

14:53

Expedia kayak it’s taking the banks

14:56

around the world 24 in particular and

14:58

helping them find the student find the

15:03

consumers find the credit cards and more

15:05

so that they can deploy some of that

15:07

cash on their balance sheet and help

15:09

some of those people and students and

15:11

like Priceline and Expedia and kayak

15:15

those entities are worth more than the

15:17

airlines and car companies and hotels

15:19

together and that’s credible opportunity

15:21

is to really become that connector that

15:24

ecosystem between the bank’s people

15:28

students credit cards and so much more

15:30

the IPO was oversubscribed and the

15:33

demand around the world in asia

15:35

australia is great we’re very excited as

15:37

a team hiring and attending around the

15:39

US as well ya know I mean and especially

15:40

given the fact that with a with a 17

15:43

year old daughter who’s going to be

15:44

going to college next year and there’s

15:46

obviously people in the audience whose

15:48

children are going to college credible

15:50

is certainly

15:52

very interesting alternative to the

15:54

traditional banks and as far as DocuSign

15:57

goes like you said you mentioned health

15:58

care as well there’s so many different

16:00

things that you can use the solution for

16:03

I know in doing a lot of trust in the

16:05

states right now you can’t digitally

16:07

shine wills and trusts and estates but

16:10

one day down the road when you are able

16:12

to do that I can continue to see in

16:15

other areas and other industries how

16:17

DocuSign will just continue to grow

16:19

exponentially so totally agree I can’t

16:22

believe people still receive mail and

16:25

FedEx packages or emails and print them

16:29

sign them and then FedEx them back

16:31

somewhere I think that whole thing will

16:34

be foreign to the next generation they

16:36

just won’t believe we did it that way

16:38

and it’s so much better for the

16:39

environment as well to not have paper

16:42

you know today prosper actually has

16:44

originated over 10 billion dollars in

16:47

consumer loans so it’s actually

16:49

established itself as you know as a

16:52

leader in marketplace lending as a

16:54

platform but you know when you first got

16:57

started in FinTech it wasn’t all you

17:00

know success immediately so can you tell

17:03

the audience because obviously they’re

17:04

going through their own struggles and

17:06

their own businesses to help them start

17:08

up what type of setbacks that you

17:10

actually encountered and how you

17:13

actually overcame those obstacles

17:15

absolutely I was actually a customer of

17:17

prosper I was a investor in the loans

17:20

and I got to know the team and the data

17:23

and the infrastructure and the

17:24

opportunity and my two partners Erin and

17:27

Steve and I had successfully exited

17:29

another company and sold it to a bank so

17:32

we thought we’d have an opportunity to

17:34

invest in prosper we were very fortunate

17:36

that Sequoia Capital which backed us

17:38

that our previous company Merlin would

17:40

also back up again as a management team

17:42

and an opportunity so we got to prosper

17:45

there were 77 people there was a monthly

17:49

loss on a cash flow basis there wasn’t

17:52

the best winning culture and some

17:54

technical deficit and some good

17:56

competitor and so we had to really go in

17:59

and shake up the company one third of

18:02

the company had to go one third could

18:04

stay right where it was

18:05

really one third needed to change seats

18:07

on the ship and that’s really the Jim

18:09

Collins good to great philosophy that

18:12

many great entrepreneurs should follow

18:13

and read or reread that book so many

18:16

great lessons in it we went out and told

18:19

our version of the story we improved

18:21

credit and we started talking to the

18:24

borrowers and lenders and following what

18:26

the competition was doing and really

18:28

leapfrogged much of the industry prosper

18:31

was the first one to do securitization

18:34

so that Blackrock old Citigroup and the

18:36

big big investors can come in and only

18:39

loaned leverage them securitize them and

18:42

sell them as bonds and that happened in

18:44

late 13 in early 14 and we kind of

18:46

shocked the industry bringing our

18:48

expertise from wall street from Silicon

18:51

Valley that thin tech mentality that

18:54

innovation that agility and the courage

18:58

and the bravery to try something new to

19:00

see if we could make it work

19:01

and we saw all the competitors follow on

19:04

with securitization institutions rating

19:07

agencies and other kind of structures

19:09

that really accelerated the industry and

19:11

so I think the key is people having

19:15

everybody rowing in the same direction

19:17

understanding the mission of the company

19:19

not really change chasing shiny objects

19:23

and staying focused and executing it has

19:26

been a lot of fun I spend a lot of time

19:29

at prosper I would there yesterday and

19:30

this team is continuing to excel it’s

19:33

exciting to see ya know and you have

19:36

mentioned Sequoia Capital and a lot of

19:38

the entrepreneurs out there are trying

19:40

to raise their own money what type of

19:43

advice would you give a young startup a

19:46

young entrepreneur a business owner

19:48

that’s obviously trying to take it to

19:50

the next level to basically get money

19:53

borrow money or basically find investors

19:58

in their business I think it’s a very

20:02

focused presentation it does not include

20:05

the words um I mean yeah you know and

20:09

like it’s an articulation of who you are

20:12

as a person as an entrepreneur what is

20:15

the total addressable market what would

20:18

you do

20:18

with the money if the venture company

20:20

gave it to you what is the arc of the

20:23

product and the company as you see it

20:25

what is the team you have together and

20:27

how are you going to execute how are you

20:30

going to deal with economic changes

20:32

political changes interest rate changes

20:34

and the incumbents maybe challenging

20:37

your idea I think it has to be very

20:40

crisp and I think you have to be fast on

20:42

your feet to be able to pivot as

20:45

businesses change and show these venture

20:47

capitalists and these investors main

20:50

seed investors these family offices that

20:52

you’re all in that you’re willing to do

20:54

whatever it takes to make this company

20:56

successful you know there’s so many

20:59

hurdles of building online platforms

21:01

obviously being the fact that prosper

21:04

and Lending Club were the first you

21:06

still had your own hurdles to sort of

21:08

overcome but for new people trying to

21:12

come into this space whether it be in

21:13

the FinTech space or in any other

21:15

industry can you talk to us a little bit

21:17

about some of the things that you can do

21:21

to make it a little a little easier to

21:25

sort of you know gain some entry

21:28

absolutely I think every entrepreneur

21:30

should draw a picture literally a

21:33

picture of a three-legged stool so for

21:37

uber for example passengers on one side

21:39

drivers on the other and then in the

21:41

middle are the technology people the

21:44

accounting people the management

21:45

marketing and understanding how

21:48

efficient and how everything works for

21:51

the customer experience and the same can

21:54

be said for online lending so the right

21:56

leg or the right side of the stool is

21:58

the borrower the person the student the

22:01

mortgage the business the left side is

22:03

the money it’s the investor it’s the

22:05

debt it’s the peer-to-peer or the

22:08

institution or the securitization and

22:10

the middle leg is the pricing credit

22:13

risk and underwriting engine the

22:15

validation verification and operations

22:18

and customer service team the engineers

22:20

marketing and accounting team and really

22:22

understanding is there equilibrium is

22:24

there inefficiency are you tilted is

22:28

there are there more in Duster than

22:30

borrowers or vice versa

22:32

and really visually being able to

22:34

understand and see how the business is

22:37

running and where the pain is where’s

22:39

the opportunity is it in the efficiency

22:42

is it in marketing is it in the capital

22:44

market side I think that three-legged

22:46

stool works for almost every business

22:49

I’ve seen it certainly worked for Airbnb

22:51

right sure it is to stay people who want

22:55

to stay and the middle is the operations

22:57

in the application and the technology in

22:59

the service and so I think when you can

23:01

visualize the business and see where the

23:03

problems are or the single-threaded

23:05

parts of the stool it really helps in

23:08

fixing and growing and excelling as a

23:11

company and the fact that you’ve been

23:13

involved in so many of your own

23:15

investments in so many successful

23:16

companies it sort of comes across that

23:19

way that that obviously you’ve given

23:21

this a lot of thought and that’s the

23:23

reason why the audience is going to

23:25

really appreciate all of this really

23:27

good practical advice that you’re

23:29

providing let’s let’s turn now to

23:32

competition and partnerships because we

23:35

receive Lending Club with Webb Bank we

23:37

see on deck with JPMorgan we see cabbage

23:39

with Santander we see self I out there

23:42

event and we see next year goldman sachs

23:46

you know coming with with marcus so how

23:48

do the online lenders remain competitive

23:51

and what do they need to do to continue

23:54

that competitive it such a great

23:57

question prosper also has a great

23:59

relationship with webb bank i think one

24:01

of the key things is how our each of

24:04

these company is going to acquire more

24:07

customers more borrowers in unique and

24:10

efficient and lower CPA cost per

24:14

acquisition or cost per click what is

24:16

the difference or differentiator in

24:19

customer acquisition the second part is

24:22

how are these companies going to lower

24:24

their cost to capital you brought up

24:27

Goldman Sachs’s markets is a great

24:29

success story they started with very low

24:31

cost of capital

24:32

given they have billions of dollars of

24:34

cash earning 1% from their clients and

24:37

then how are these companies going to

24:39

hire the engineers that are going to

24:41

make the mobile experience better make

24:44

this

24:45

product work and integrate and expand

24:47

globally I think all of these companies

24:49

share that lower unique ways to find

24:52

customers increasing the education

24:55

awareness and understanding lower cost

24:58

to capital diversifying capital new

25:00

products and efficiency these are really

25:03

the challenges of all those companies

25:04

that you mentioned you know let’s talk a

25:06

little bit about market share and the

25:09

peer-to-peer as a new asset class for

25:12

those whether they’re actually being

25:14

investors or they’re actually looking as

25:16

startups to borrow from these

25:18

alternative platforms can you provide

25:21

some details about the risk and this

25:23

Bank smarter alternative for those

25:26

investors out there and the borrower’s

25:29

absolutely what a great time to be an

25:32

investor a retail investor or an

25:35

institutional investor there are so many

25:37

great alternative tricks to income

25:40

opportunities clearly Lending Club and

25:42

prosper and Sophie and Marcus on the

25:45

consumer side but there’s also on the

25:47

real estate side lending home and patch

25:51

of land and peer Street and lending one

25:53

in litigation finances yield Street in

25:56

some of the subprime or mid prime there

25:59

is money Lyon and lend up and on and on

26:03

and on student loans etc so investors

26:06

have many many choices on where they can

26:08

put their money across asset classes

26:10

both small and big and on the borrower

26:13

side what a great opportunity they can

26:15

go to Lending Tree or Credit Karma or

26:17

other places that will help them find

26:20

the best opportunity when a student goes

26:23

to or a consumer goes to credible they

26:25

get hard offered from the best most

26:28

competitive banks competing against each

26:30

other for the best rate the best

26:32

solution the best product with a great

26:34

customer experience for that consumer

26:36

student or credit card purchaser so I

26:39

think it’s a really efficient time great

26:42

solutions whether you’re an investor or

26:44

a borrower and you know we’ve talked

26:46

about so many different resources

26:48

because we’re really big Ronal resources

26:51

for entrepreneurs out there and also for

26:53

investors and so I’m actually going to

26:55

have not only all the

26:57

for today’s show but any links to any of

27:00

the companies that we’ve actually talked

27:02

about will actually be able to find that

27:04

back at Mitchell chadroy comm slash show

27:07

zero five five so this is really

27:09

excellent we’re all about

27:10

entrepreneurship here on the listen up

27:13

show and the fact that you also enjoy

27:16

teaching and that you travel the world

27:18

teaching about lending whether it a

27:21

living Academy I just saw that you’re

27:24

heading to to Africa I think to teach

27:26

learning and entrepreneurship so can you

27:28

tell us a little bit about that I always

27:30

wanted to be a teacher from the very

27:32

beginning I thought that the learning

27:35

aspect was fascinating and I had the

27:38

chance to teach at Cornell and Fordham

27:40

and pace and Berkeley and Stanford in

27:43

Southern California I’m actually heading

27:45

to Hawaii in February to teacher class

27:47

listening just come back from Southeast

27:49

Asia in sharing my observations

27:52

experiences in the state and the lessons

27:55

along the way I think entrepreneurship

27:57

is not only hard but it’s lonely and

27:59

there’s only so many people an

28:01

entrepreneur can really talk to some

28:03

conversations are difficult to have with

28:05

the board or your management team or

28:07

your CFO and all entrepreneurs need a

28:10

mentor need an advisor or an advisory

28:13

team and at 53 I’m one of the elder

28:16

statesmen in the industry we are trying

28:18

to pay it forward and give it back and

28:20

help those young entrepreneurs because I

28:23

had a lot of help along the way from

28:25

some great advisors and great

28:27

entrepreneurs and I’d love to see some

28:29

of these younger entrepreneurs in their

28:31

late 20s and early 30s achieve what they

28:34

can in the years ahead

28:36

understanding the lessons I’ve learned

28:38

and try not to repeat the mistakes I’ve

28:40

made you know you may have already

28:42

covered this particular answer when you

28:45

were talking a little bit about you know

28:47

the future of FinTech but can you delve

28:50

a little bit more into the future of

28:51

finance generally I sure can I gave this

28:56

presentation called the golden era of

28:59

FinTech which resonated I’ll it just

29:01

gave it in Singapore and Australia in

29:04

Mexico City and around the u.s. we’re in

29:08

this next ten year period and

29:10

actually nobody knows who the winner is

29:12

in the golden era but if you understand

29:16

where you are today where you stand

29:19

today and you understand who’s coming in

29:22

and what the players are doing you’ll

29:24

have a much better chance of succeeding

29:26

in the golden era this next 10 years the

29:29

middle 10 years of the FinTech

29:31

innovation cycle and so some of the

29:34

winners are becoming a little more clear

29:36

look at PayPal stock price look at

29:39

squares stock price look at what some of

29:41

these incumbents are doing in the

29:43

technology world like Amazon like

29:45

Facebook look at what some of these

29:48

groups are doing globally you’ve seen

29:50

for Chinese FinTech companies go public

29:53

one yesterday in the US and some are up

29:56

100% this year so really understanding

29:59

where you sit today kind of what the

30:02

opportunity is and how do you work with

30:04

the incumbent banks tech companies

30:07

telecom companies and others and move

30:09

over to capture the minds and hearts and

“The post Financial Services Fintech Lessons Learned Rewirement Ron Suber Show 055 first appeared on mitchellchadrow.com

Ron Suber was President of Prosper Marketplace and is a Lending Industry Legend. Ron has been called the “godfather of fintech” by San Francisco Business Times, and the “go-to” guy for fintech innovation.”

30:12

imaginations and wallets of this next

30:15

generation which we now call the I

30:16

generation because they’ve always had

30:19

internet and they’ve always had an iPod

30:20

they’re different but if you can capture

30:22

them early great successes ahead the

30:24

next question is a different twist on an

30:27

earlier question I had asked you and

30:29

that was in terms of people going and

30:32

what should they how they should present

30:34

themselves to future investors let me

30:37

let me take that and go a little bit

30:38

deeper if I could what do you actually

30:40

look for you personally before you

30:43

actually make an investment in a

30:45

financial technology company or really

30:48

run any any other company I look at the

30:50

person and the people and the management

30:53

team and I’m trying to find out what is

30:56

the balance between the IQ EQ and aq of

31:00

that person of that entrepreneur IQ is31:04

clear it’s their intelligence quotient

31:06

of smart are they how big is that

31:08

processor on their head are they a quick

31:10

learner have they retained lots of

31:12

information into is that emotional

31:14

potion can they read nonverbal thing and

31:16

tip and cues in the room and aq is as

31:19

important as the others and that’s

31:21

adversity quotient and that’s true

31:23

Williams and grit is just someone who

31:25

gets punched and lays down or cries or

31:28

complains or just someone who gets up

31:30

and fights and will be standing in the

31:31

12th round no matter what I look for

31:34

that balance between all three of those

31:36

I’m also looking for someone who has

31:38

passion who believes in what they’re

31:40

doing and whose sacrifice to get there I

31:42

think those are really key components of

31:45

the management leadership team if an

31:48

entrepreneur can come in and very

31:49

quickly articulate where they’re going

31:53

what they are what they aren’t how

31:56

they’re going to get there and how they

31:58

compare to others who says they’re like

32:00

this company and who does this company

32:02

think it’s like if you can see that

32:05

combination that storyteller that vision

32:08

the dream and the passion I look hard at

32:12

investing in the equity debt and or

32:14

advising you know when I was thinking of

32:17

this next question I think you kind of

32:19

hit it in terms of it’s almost like your

32:21

gut feel in terms of knowing people well

32:24

and one of the things when I was reading

32:26

up on you before this interview that

32:28

impressed me the most was the fact that

32:31

you’re basically a natural networker

32:34

you’re a connector of people you enjoy

32:36

naturally building relationships tell us

32:40

a little bit about what your secret is

32:42

like how do you actually do it well I

32:47

listen a lot and I watch a lot I do love

32:51

to meet new people I love to hear

32:53

people’s story their idea I love it when

32:56

someone says my last business failed but

33:00

here’s what I’m doing next for me those

33:02

are the most interesting opportunities

33:04

I’m also really excited to be with young

33:07

and younger people sometimes I work at

33:09

companies advise companies where the

33:11

employees are literally younger than my

33:13

children who are on their mid-20s and so

33:16

I am really engaged in people from other

33:20

countries who are coming from different

33:23

backgrounds I loved going to Mexico City

33:25

I loved working with entrepreneurs some

33:28

cultures you’re historically they were a

33:30

really afraid to fail but now there’s

33:33

incubators and entrepreneurs and capital

33:35

helping these young entrepreneurs

33:37

do what they’ve always dreamed of I

33:39

think what’s happening in Singapore and

33:41

Shanghai and Hong Kong is truly

33:43

fascinating and the emerging scene in

33:46

Melbourne Australia and Sydney is also

33:49

very electric I’ll be back there two or

33:52

three more times in 2018 as I was in

33:55

seventeen he’d give us a few key

33:58

observations you mentioned that you’re

34:00

enjoying what they’re doing there can

34:02

you you might have touched on it earlier

34:04

but if you could just give us one or two

34:06

clear clear examples that would be great

34:08

from a practical perspective absolutely

34:11

so there was an entrepreneur in Mexico

34:13

City that I met and he was having

34:16

trouble sending money to somebody in

34:18

another country so the company’s called

34:21

friendly transfer and he worked out a

34:23

way that for example I’m going to

34:25

Patagonia in a couple weeks I could send

34:28

money down there six months ago

34:29

it could be lent around and borrowed and

34:32

lent around over and over and over down

34:34

there the people down there don’t have

34:36

to get money from North America and pay

34:38

the transfer fee and pay the interest

34:40

and then when I get to Patagonia my

34:42

money down there and has grown and so

34:45

this concept of this guy in Mexico City

34:48

helping people in Peru and Colombia and

34:50

Chile with money transfer transferring

34:54

it in a friendlier way kind of like

34:56

Airbnb sharing your apartment around the

34:59

world you can now share your money

35:00

around the world but this entrepreneur

35:03

learned this from his own problem and

35:04

getting money to other countries where

35:07

you had exchange fees and costs to move

35:10

the money and this is I think one of the

35:14

brand new ways to solve the exchange

35:17

rates and the problems in getting money

35:19

around the world I think it fits right

35:21

into the whole cryptocurrency and

35:23

eliminating all the friction of

35:25

transferring money holding money and

35:28

using a physical capital one of the

35:30

things that I love our books and the

35:34

entrepreneurs that listen to this

35:36

podcast also love books I know that you

35:38

happen to have mentioned earlier an

35:41

excellent book good to great if you

35:44

could recommend one other book because I

35:46

have actually a book club at Mitchell

35:48

trader.com slash box

35:50

and what I do is I link up to the book

35:53

that our guests actually references so

35:55

that the audience member can sort of go

35:59

and not only purchase it but get some

36:01

additional ideas that they can gain from

36:05

that can you can you recommend another I

36:07

sure can in fact Bloomberg called me

36:10

last month and asked me the same

36:11

question and I answered the question and

36:14

my book recommendation made their top

36:17

books of 2017 and I’m well that’s

36:20

awesome for your readers so the book is

36:22

called supernormal it was actually

36:25

highlighted in the Wall Street Journal

36:26

two months ago it is a fascinating book

36:30

written by a woman and I apologize I

36:31

don’t remember her name she is great and

36:34

she’s really articulated back to this

36:37

concept of resilience which is really

36:40

part of a queue and she talked about the

36:43

importance of resilience and the lessons

36:45

of resilience and the way to find

36:47

resilience when you need it most and

36:49

pass on the concept and I think that

36:52

supernormal book is a must read for all

36:55

entrepreneurs because as you know you

36:58

can have a great day and a terrible day

36:59

all in the same day as an entrepreneur

37:02

and you need resilience in this book

37:04

nailed it yeah I know that that’s that’s

37:07

that’s great Ron and I certainly will

37:09

link up and can do that right at the

37:12

show notes as well reason why I chose

37:16

books sponsor my fast pitch round that’s

37:18

easy I love books and books it’s owned

37:21

by a powerful company that stands behind

37:23

all their products was willing to offer

37:25

an exclusive free 30-day trial to my

37:28

podcast listeners with one free

37:30

audiobook download any listener doesn’t

37:33

like their books exchange it and you can

37:35

cancel at any time

37:36

keep your free download and you can

37:38

choose from over 180,000 bestsellers new

37:42

releases classics and more I recommend

37:44

the last lecture by Randy posh so dream

37:47

big and inspired and listen up go on

37:49

over to Mitchell chadroy comm slash

37:51

books again hit on over to Mitchell

37:54

chadroy comm slash books it’s your

37:58

number one resource for books as I was

38:01

reading more about you

38:04

in the industry it said here that you

38:07

are actually called the godfather of

38:09

FinTech

38:10

and yet you seem to be such a humble

38:13

person for so much that you’ve achieved

38:15

so how does that moniker actually make

38:18

you feel old

38:20

at 53 Ron well I think labels are for

38:24

soup cans not for people I study I love

38:28

a mayor of FinTech and godfather of

38:31

inside jokes that people make they play

38:33

The Godfather music when I go on stage

38:34

usually I’m really just very self-aware

38:37

I meditated this morning and I’m really

38:40

just trying to fish share and be a good

38:42

part of this ecosystem globally and

38:44

fintax you talk about meditation you for

38:47

me because I actually I’m all about

38:49

balance as you know so it’s about you

38:51

know how do you you talked about you

38:53

know the stool with three legs and the

38:55

way that I envisioned that with just

38:56

everything is business family and life

38:59

and if you only focus on one to neglect

39:01

one or two of the others that what do

39:03

you really have how do you have a son

39:05

you have a daughter you’ve been married

39:06

for 26 plus years how do you balance it

39:09

all really I mean now you’re traveling

39:11

you’re invested in all these companies

39:12

how do you do it so for me every day and

39:16

I mean every single day I try to set my

39:19

intention for that day Who am I as a

39:22

husband as a father as a friend as a

39:24

professional as a coach of the speaker

39:27

because all day long there are people

39:30

bumping into me in the grocery store

39:31

cutting in front of me on the street and

39:33

trying to move me off my intention all

39:36

this news we’re seeing fake or real and

39:39

all the just behavior by people around

39:41

the world knocks people off their

39:44

intention for the day and so Wayne Dyer

39:46

has been one of my gurus about all of

39:50

your yeah the power of intention and

39:52

your daily intention and I really try to

39:55

do that and yeah I get knocked off once

39:58

in a while during the day but I find if

40:00

I get up have coffee with my wife watch

40:02

the Sun Rise meditate set my intention

40:05

and then go try to stay and execute on

40:07

that intention and then reset at the

40:10

next day it really helps me be the best

40:13

I can be in retirement well I’ll tell

40:14

you what it’s well said you’re obviously

40:16

well

40:17

spoken it’s funny because we had a guest

40:20

on who created this or I at-at talks all

40:23

about taking out the arms and you know

40:25

when people say like or what have you to

40:27

tell that you’re very you speak

40:29

obviously very well in closing here can

40:32

you tell us three main takeaways for the

40:36

audience that you’d like to leave us

40:37

with

40:38

I think the audience needs to recognize

40:40

how hard this is some people make it

40:43

look easy like a column on the top and

40:45

the peak on crazy under the water but

40:47

this is really difficult and they should

40:49

be good to themselves and try to be

40:52

honest with themselves and others I

40:54

think the other second piece would be

40:57

focus and execution stay focused and

41:00

keep executing in good times I see

41:03

people lose their focus and a bad time

41:05

and the last one is just try to have a

41:09

little more fun I see entrepreneurs so

41:12

stressed out and working so hard is just

41:16

to take a break and be grateful

41:18

especially at this year end and this

41:20

holiday season be healthy call someone

41:23

tell them how helpful they been and get

41:25

ready for the marathon and 2018 ahead

41:28

I’ll tell you what Ron there have been

41:30

so many value bombs in this show today

41:33

so much wisdom and you’ve provided so

41:36

much time and insight to our audience we

41:39

truly want to thank you so very much you

41:42

know earlier in our conversation we had

41:44

talked about graphic designers and you

41:46

had mentioned batteries included

41:50

graphic designer sponsors the wrap-up

41:53

rim I needed help with my graphics for

41:56

all my social media so if you head on

41:58

over to Mitchell chadroy comm / graphic

42:00

designer

42:01

is there someone else that you can

42:03

recommend in terms of a graphic designer

42:06

for the audience batteries included how

42:08

are you going to stay in contact with

42:10

Ron silver you can get the show notes at

42:13

Mitch with Chad Road comm slash show

42:15

zero five five people are going to want

42:18

to obviously stay in contact with you

42:20

what’s the best way for them to do that

42:22

I’m on LinkedIn and I’m on Twitter

42:25

I’m on WeChat and whatsapp all those are

42:28

wide open and I look forward to engaging

42:30

again with you and of course your

42:32

audience well real soon Ron this has

42:34

been awesome thank you so much I’ve

42:37

really thoroughly enjoyed it here you

42:40

sound like a terrific guy and someone

42:42

that we’re certainly going to keep in

42:43

contact with and we hope to be in touch

42:45

real soon you take care of you later

42:47

happy holiday your happy Halloween to

42:49

you and your family take care now Ron

42:51

Bob out here until next time please

43:00

subscribe to my email list at Mitchell

43:03

chadroy comm slash sign up you will get

43:05

all the full interview transcripts my

43:08

ebook 30 tools to start off where I talk

43:10

about these free resources in show 0:06

43:14

you’ll get the startup checklist

43:16

education and training materials and

43:18

other resources just by signing up at

43:20

Mitchell chadroy comm slash sign up back

43:23

at Mitchell chatter a.com slash sign up

43:26

totally boost the rankings of the listen

43:28

up show the startup entrepreneur podcast

43:30

by providing a well-written review in

43:33

iTunes

43:34

Mitchell chadroy comm slash iTunes it

43:36

helps other people find the show if you

43:39

actually need instructions or how to do

43:41

this you can find that back at Mitchell

43:43

Chad Road comm slash sign up thank you

43:46

so much for subscribing to my email list

43:48

and providing a written review on iTunes

43:53

[Music]

44:14

you

Financial Services Fintech Lessons Learned Rewirement Ron Suber Show 055

Gary Pudles, (@GaryPudles) is the founder, and CEO of Answernet, was named by Inc. Magazine Inc. 500, as one of the “fastest-growing businesses” …

Dennis Shields Listen Up Show Business Podcast Interview Mitchell Chadrow

Financial Services Fintech Lessons Learned Rewirement Ron Suber Show 055

The Story Behind Rewirement Click edit button to change this text. Lorem ipsum dolor sit amet, adipiscing elit. Ut elit tellus, luctus …